The Buzz on What Is Trade Credit Insurance

What Is Trade Credit Insurance Things To Know Before You Buy

Table of ContentsExcitement About What Is Trade Credit Insurance5 Simple Techniques For What Is Trade Credit InsuranceWhat Is Trade Credit Insurance Can Be Fun For Everyone

During the year, if any of those customers go bust or do not pay, then we will make the payment. We consider the whole turnover of a company as well as we finance the entirety. "What we're seeing with electronic systems is that individuals can browse the web and can market a solitary billing.

The platforms can see the invoices that are outstanding as well as can make an offer to get those superior invoices. What the client can then do is take the selection to guarantee that solitary billing. As soon as that billing is guaranteed, it's basically a guarantee that the billing will certainly be paid - What is trade credit insurance. "At Euler Hermes, we think there's going to be a shift in the means profession debt insurance policy is dispersed.

What Is Trade Credit Insurance Things To Know Before You Buy

Required a broker? See our overview to finding the ideal broker.

For instance, a producer with a margin of 4% that experiences a non-payment of 50,000 would certainly need 25 equal sales to offset a single instance of non-payment. Credit rating insurance mitigates versus this loss. You can cut investing on credit report info as that's covered, as well as you won't need to throw away sources on going after collections.

You may have the ability to work out good terms with your vendors as a credit history insurance coverage decreases the influence of an uncollectable loan on them and also possibly the entire supply chain. Credit insurance is there to aid you click reference stop and go to the website alleviate your trading dangers, so you can create your business with the knowledge that your accounts are shielded.

A company desired to increase sales with its present clients however was not entirely comfy offering them higher credit line. They contacted Coface credit insurance to cover the higher credit line so they can raise the quantity of credit report provided to clients without threat - What is trade credit insurance. This let them grow earnings and also provide even more earnings.

Some Known Details About What Is Trade Credit Insurance

"From the preliminary purpose of providing comfort to our financial institutions, the service added depth to our service choices." The interaction permitted the business to examine its customers' condition more precisely as well as has been a valuable device in organization growth.

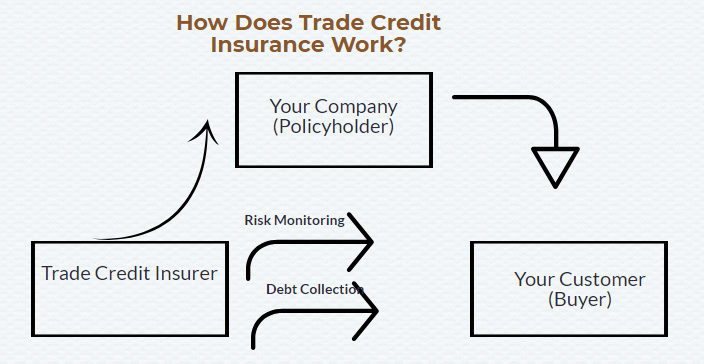

Australian services owe around $950 billion to various other companies. Which indicates it's crucial to have protections in position so that in the occasion look at this site a lender does not meet its commitments, the company can still recover its money. Getting trade credit rating insurance is one way you can do this. Trade credit score insurance gives cover when a client either comes to be financially troubled or does not pay its financial debts after a certain duration (which is set out in the insurance plan).

"In the occasion a financial obligation is unpaid, the policy owner might have the ability to claim up to 90 percent of the quantity of that financial obligation, thinking about any type of excesses that may be relevant," he includes. When it comes to collecting the financial obligation, often the insurance firm will certainly have its very own financial obligation collection firm and will certainly seek the financial debt in support of business.